Minuteman Press |

The HRA or Health Reimbursement Arrangement allows your employer to easily reimburse you for individual medical insurance and other out-of-pocket medical, dental and vision expenses. Reimbursements are tax free to you. Your HRA funds are available on a convenient debit card.

- 90 day waiting period to participate

- After 90 days - Contribution is $125 per month

HRA DEBIT CARD:

You are eligible to swipe your HRA Debit Card for any qualifying medical, dental or vision expense for you or immediate family. Common uses are copays, deductibles, glasses and dental work. The card can not be used for anyone outside your tax filing household, cosmetic procedures, nutritional supplements, or diet plans.

Make sure to login online at https://joinisg.summitfor.me to check you account balance or submit claims.

You are eligible to swipe your HRA Debit Card for any qualifying medical, dental or vision expense for you or immediate family. Common uses are copays, deductibles, glasses and dental work. The card can not be used for anyone outside your tax filing household, cosmetic procedures, nutritional supplements, or diet plans.

Make sure to login online at https://joinisg.summitfor.me to check you account balance or submit claims.

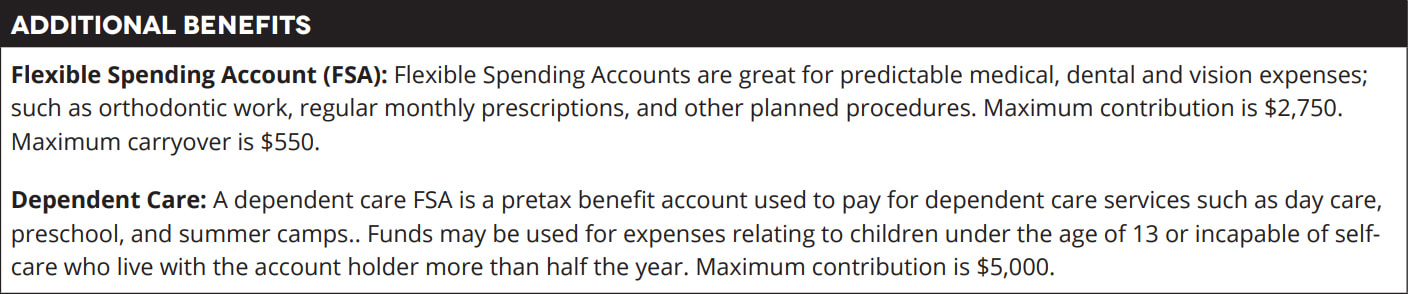

FSA AND DEPENDENT CARE:

You can contribute funds to a flexible spending account or dependent care account which help you save money on medical and dependent care expenses. These funds are available on your HRA Debit Card and also reduce you taxable income.

You can contribute funds to a flexible spending account or dependent care account which help you save money on medical and dependent care expenses. These funds are available on your HRA Debit Card and also reduce you taxable income.

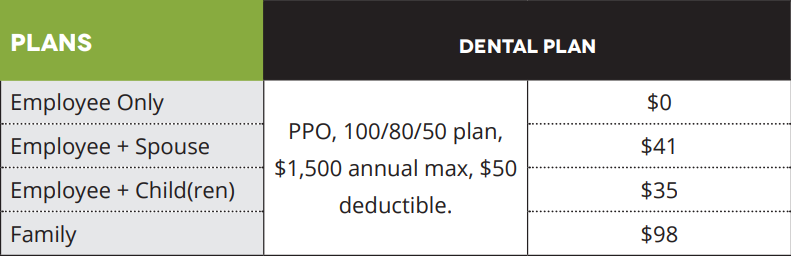

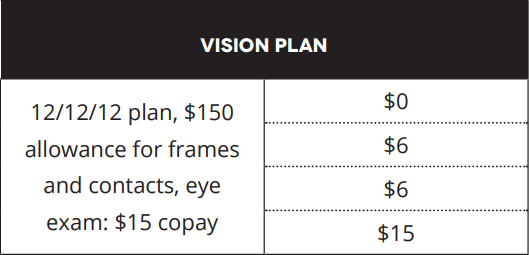

EMPLOYER PAID DENTAL & VISION:

Minuteman Press pays 100% of employee dental and vision benefits. See backside for benefits and rates

Minuteman Press pays 100% of employee dental and vision benefits. See backside for benefits and rates

|

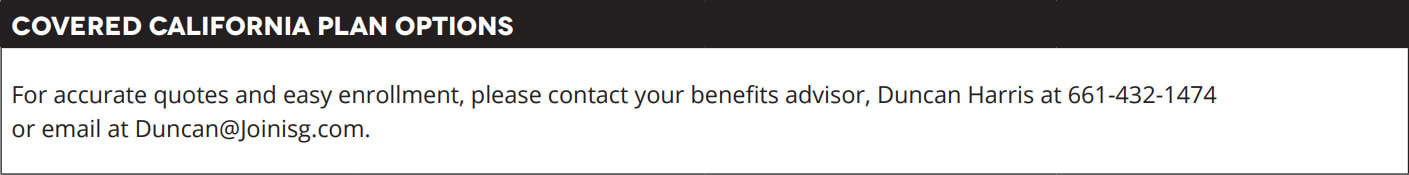

Open enrollment is during your 90 day waiting period. We encourage you to contact your benefits advisor, Duncan Harris, to help your current benefits to ensure they are still in line with your needs. You must submit changes if you want to:

|