ISG Benefits and Insurance Services Blog |

|

Most people will cram long-term care info and comparison facts right before their purchase. So instead of diving into the minutia and details of each policy type, this article will offer my observations, experience, and wisdom to help you through the buying process. 3 types of policies

Evaluate these policies based on traditional factors such as monthly premium, waiting periods, and long-term care benefit amounts. These policies will be better suited to those clients who will have a fixed income in retirement with limited assets.

These policies are more expensive than traditional policies but offer greater protection and more control over your long-term care benefits. These policies are superior compared to traditional plans but they can be cost prohibitive. With their flexible funding options, such as single premiums and short-pay options, these polices will only make sense to the more financially savvy and affluent client.

If you are lucky enough to be offered a group long-term care policy, the monthly costs should be lower than the other two options listed above, the premiums are usually fixed and will not increase with age, and you should be able to take the policy with you when you leave the company. If you’re offered a group policy that meets these requirements, then BUY IT! Long-term care facts

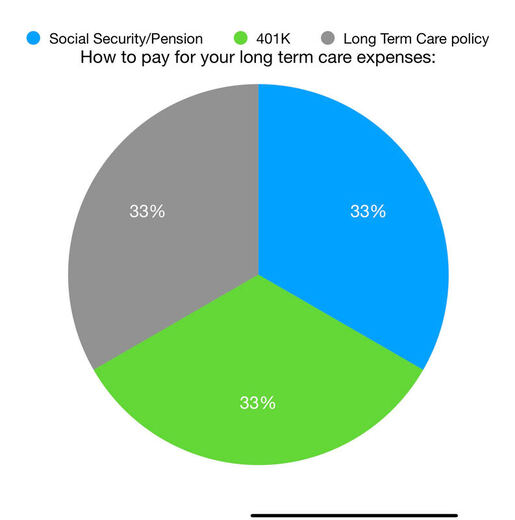

How to pay for Long-term care Most people will start their long-term care with home care and then transition through the various stages and levels of care, usually from least expensive to most expensive. If the average cost of care is roughly $100,000, and the average claim is 2 years, then plan on spending $200,000 for your long-term care needs. Dont forget to consider inflation; odds are you will have a claim at age 70 or later. Now that you can roughly predict when, and how much your care will cost, divide that cost by your monthly social security or pension, your income producing assets like 401k, and then finally a long term-care policy. When should you purchase long-term care coverage?

This question is subject to much debate with many so-called experts disagreeing on whether you should buy young or wait to buy when you are older. Most will agree however that you should purchase coverage between the ages of 50 and 60. I believe that your early 50s are the ideal buying age, and here is why: The younger you buy, the lower your premiums will be. The lower your insurance premiums are, the more money you can actually invest and save for retirement and your estate. Or put another way, odds are you will be healthier when you are younger compared to when you are older, so lock in those lower rates while you can. Should I buy long-term care insurance?

You’ll have this policy for the rest of your life so make sure the policy fits your budget. If you cant afford to pay the premiums then the policy will cancel and you will could be left with nothing after paying thousands in premiums over many years.

Most of my clients intend to pass on their assets to their children. If long-term care expenses deplete your estate so there is nothing left, then you should consider purchasing a policy. Or, consider whether your long-term care expenses would put a burden on your children and your family. Summary It’s important to consider that long-term care is a very personal issue shaped as much by emotions, family dynamics, and communications, as it is by the fiscal concerns generally associated with these discussions. With all of this in perspective, you should know that long-term care insurance can protect your family finances, and so much more. If you are interested in a quote, or need help evaluating long-term care coverage offered through work, then please contact our office.

0 Comments

Leave a Reply. |

Contact UsToll Free: 1-800-220-3304 Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed